Cost of Bad Credit

How much does a low credit score cost you?

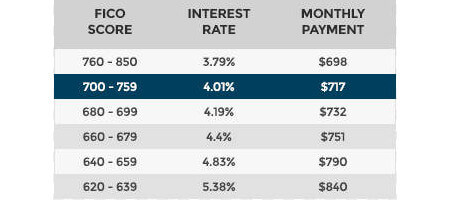

So what's really the cost of bad credit and why should you even bother with credit repair. Simply put, when it comes to mortgages, auto lending and credit cards, the lower your credit score, the higher the interest rate you're going to pay. Over the course of a vehicle or mortgage loan, the cost of bad credit can reach thousands or even hundreds of thousands of dollars in interest payments. A report by the Consumer Federation of America estimates that consumers could save about $16 billion a year in lower finance charges by improving their credit scores by an average of 30 points!

Having a good credit score simply means it will be easier for you to get loans and lower interest rates. Lower interest rates on the other hand means smaller monthly payments.

What Does Your Credit Score Affect

Your credit score can affect:

Interest rates you pay on a installment loans.

Interest rates on your credit cards.

Your ability to rent a house or apartment.

Your ability to get approved for a mortgage to purchase a house.

Higher premiums on some insurance products.

We are going to make some general assumption to give an idea of how much more it costs a person with poor credit compared to one who has good credit. The amount a person with poor credit must pay, which are the figure in the "Cost of Bad Credit" column in the tables below, may surprise you.

Cost of Bad Credit

Credit Cards

Credit Cards

Most, if not all, prime credit cards are entirely out of reach to consumers with bad credit. And the few credit cards that are available to them (known as "sub-prime" cards) typically require exorbitant setup fees or recurring monthly fees. They offer very low credit lines, require cash deposits, and in most cases do not even report your positive credit activity to the credit bureaus.

Automobile Financing

Automobile Financing

If you are making payments on a car, you are probably paying between $5,000 and $9,000 more just for having bad credit. This added interest shows up every month in a higher payment. Take a look.

| CREDIT STATUS | RATE | PAYMENT | COST OF BAD CREDIT |

|---|---|---|---|

| Perfect | 10% | $424.94 | $0.00 |

| Mildly Damaged | 14% | $465.37 | $4,722.54 |

| Damaged | 20% | $529.88 | $8,593.30 |

Home Mortgage

Home Mortgage

Bad credit in auto financing can really hurt, but it is nothing compared to the cost of bad credit when a home is involved. A typical home can cost between $50,000 and $130,000 more in interest if you are buying the home with bad credit. Also, people with lower credit scores have to pay higher up front costs in the form of mortgage loan origination fees.

| CREDIT STATUS | RATE | PAYMENT | COST OF BAD CREDIT |

|---|---|---|---|

| Perfect | 7% | $655.30 | $0.00 |

| Mildly Damaged | 9% | $804.62 | $50,155.24 |

| Damaged | 12% | $1,028.61 | $130,791.63 |

As you can see, a low credit score can cost you hundreds of dollars per month. This is why it is so important to obtain and maintain a high of a score.

Good credit is valuable. How much credit you have, your credit rating and how you use it can make a major difference in your life. It can affect where you live and even where you work, because your credit record may be considered by prospective employers.

That is why you need to understand how credit is awarded or denied and what you can do if you have negative entries in your credit report. Your rights and what you can do if you are treated unfairly.