Credit Repair Questions and Answers

What is a credit score?

A credit score is a number summarizing your credit risk, based on your credit data. A credit score helps lenders evaluate your credit profile and influences the credit that's available to you, including loan and credit card approvals, interest rates, credit limits and more.

FICO Scores

What are FICO® Scores?

FICO® Scores are the most widely used credit scores. Each FICO® Score is calculated from the data on your credit reports at the three major credit bureaus — Experian, TransUnion and Equifax. Your FICO Score predict how likely you are to pay back a credit obligation as agreed. Lenders use FICO Scores to help them quickly, consistently and objectively evaluate potential borrowers' credit risk.

How do I interpret my FICO Score?

Your FICO Score is a three-digit number ranging from 300 to 850, with higher scores demonstrating lower credit risk and lower scores demonstrate higher credit risk.

How can I increase my FICO Score?

Research shows that people with a high FICO Score tend to:

1. Make all payments on time each month.

2. Keep credit card balances low.

3. Apply for new credit only when needed.

4. Have established a long credit history.

What is a good FICO Score?

There's no straight answer to this question, because what’s considered a "good" FICO Score varies, from one lender to another. Each lender sets its own standards for approving credit applications, based on the level of risk it finds acceptable. As a result one lender may offer its lowest interest rates to people with FICO Scores above 730, while another may only offer it to people with FICO Scores above 760.

| Score Rating | Score Range | Score Rating Description |

|---|---|---|

| Poor | 300-579 | Well below average, lenders consider this borrower risky. |

| Fair | 580-669 | Below average, some lenders will approve loans with this score. |

| Good | 670-739 | Near average, most lenders consider this score good. |

| Very good | 740-799 | Above average, lenders consider this borrower very dependable. |

| Exceptional | 800-850 | Well above average, lenders consider this borrower exceptional. |

| ** Remember that each lender sets its own standards for approving credit applications, based on the level of risk it finds acceptable. | ||

Credit Repair

Can I repair my credit report myself?

Yes. It's your legal right and you are also encouraged to tackle your credit disputes with the credit agencies and creditors yourself. Fixing your credit yourself is not rocket science. Everything a credit repair clinic can do for you legally, you can do for yourself at little or no cost.

When it comes to fixing your credit, persistence is what triumphs. If you are willing to invest the amount of time and follow-up required to coordinate disputes with all three credit reporting agencies and the creditors appearing on your credit report, then go for it.

Is credit repair legal?

Despite what you might have heard or what the credit bureaus would like to believe, there is absolutely nothing illegal about disputing questionable items on your credit report. It's actually your right by law to do so (see Fair Credit Reporting Act).

Moreover, the federal Fair Credit Billing Act affords consumers the right to request extensive information regarding billing and account history. The Truth in Lending Act stipulates conditions for establishing credit accounts. And, finally, the Fair Debt Collection Practices Act allocates specific rights to citizens regarding accounts that have passed into collection status.

Does paying my bills restore my credit?

You would think that would be true. But, the credit reporting system just doesn't work that way. When you pay an old debt, the negative credit listing doesn't disappear. Once paid, it may appear on your credit report as a paid delinquency, charge off or collection.

You won't get very far paying your debts unless you also work to restore your credit at the same time.

Do I need to pay my delinquent bill if I managed to get it off my credit report?

If there are delinquent accounts appearing on your credit reports that have not been paid off, the actual debt behind the listing remains the same even if the account is deleted from your credit report. You may still owe the same money that you validly owed in the first place subject to your state's applicable statute of limitations.

If you don't pay the debt, the creditor or a collection agency may re-report the item. So removing the listing without addressing the debt is only a temporary solution. It's advisable that you only dispute credit listings that you feel are inaccurate, unverifiable or misleading. If you feel that a negative credit listing is 100% accurate, timely and verifiable, then you shouldn't dispute it.

What does it mean to have perfect credit?

In the US, a consumer with a perfect credit is someone with a credit score of 800 or higher. Yes, there are people with credit scores over 800. An estimated 13 percent of the population fall into that category. However you don't need to have a score 800 to get a loan or good interest rate. Knowing what the credit profile of a consumer with an 800 score will help you build your own credit.

Does checking your credit reports and FICO® Scores lower your scores?

You are allowed and even encouraged to check your credit reports and FICO® Scores as often as you’d like, it will not lower your scores.

What if deleted items on my credit report reappear?

Occasionally a negative listing that was recently deleted may eventually be verified by the creditor. The Fair Credit Reporting Act requires that the credit bureau inform you before the re-report a previously deleted listing. The FCRA also makes it more difficult for credit bureaus to re-report listings. For this reason it's fairly rare for listings to come back on your credit report once they've been deleted. If a questionable credit item is re-reported, it is a simple matter to challenge the listing again at a future time to press for permanent deletion. This is why keeping good records is very important.

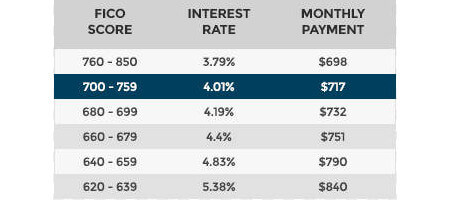

How much does bad credit cost?

Here are just a few examples of the cost of bad credit. A low credit score can cost you hundreds of dollars per month.

Can I remove a bankruptcy?

There is not one type of negative listing that cannot be removed from a credit report if it is questionable and disputable. While negative items such as bankruptcy or unpaid debts are certainly more difficult to remove from the credit report. For example, judgments and tax liens are severely negative listings yet have been considerably easier to remove.

Credit Report

How do I order my free report?

The three nationwide consumer reporting companies are using one website, one toll-free telephone number, and one mailing address for consumers to order their free annual report. To order, click on annualcreditreport.com, or call 1-877-322-8228, Annual Credit Report Request Form mailing address: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281. The law allows you to order one free copy from each of the nationwide credit reporting companies every 12 months.

Is there a charge for my report?

Under the Free File Disclosure Rule of the Fair and Accurate Credit Transactions Act (FACT Act), each of the nationwide consumer reporting companies, Equifax, Experian, and TransUnion are required to provide you with a free copy of your credit report once every 12 months, if you ask for it.

What is a goodwill letter?

A goodwill letter is a note you send to a creditor regarding a late payment that has been reported to the credit bureaus and shows up on your credit report.

The purpose of the letter is to ask the creditor to remove a negative item on your credit report as an act of goodwill.

What information do have to provide to get my free report?

To get your free credit report, you need to provide your name, address, Social Security number, and date of birth. If you have moved in the last two years, you may have to provide your previous address. To maintain the security of your file, each nationwide consumer reporting company may ask you for some information that only you would know.

I received an email offering me a free credit report. Should I request my free report through them?

No, annualcreditreport.com is the only authorized online source for your free annual credit report from the three nationwide consumer reporting companies. No other company or website or email can issue your free credit report. If you get a phone call or an email claiming it's from annualcreditreport.com (or any of the three nationwide consumer reporting companies), it's probably a scam.

Don't reply or click on any link in the message. Instead, forward any email that claims to be from annualcreditreport.com (or any of the three consumer reporting companies) to [email protected], this is the Federal Trade Commission (FTC's) database of deceptive spam.

I am making reduced payments on my loan. Will that affect my credit?

Some credit counselors will tell you it is possible to make reduced payments to your creditors without it affecting your credit rating. (the better to pay something than nothing scenario) This is not usually the case. Most creditors will add to your credit reference file to show that you are behind with your payments even if they agree to your offer.

I want to buy a new home. How can I increase my credit score and how long will it take?

There is no magical way to improve your score but over time. However to speed up the process, here are a few thing you can do.

1. Pay your bills on time.

2. Pay down your existing debt

3. Get a copy of your credit report and dispute any negative incorrect entry on your report.

4. Get all of your credit cards under 30% of the total available credit

As far as how long it takes, it all depends on what's on your credit report. You credit will improve drastically when your credit card bills are paid down or a major negative entry like medical bill is removed from your report. Your score will probably raise anywhere from 80 to 100 points. Here are more tips on improving your credit score.